Buy-and-hold for the S&P 500 returned 6.63% per annum with a 56.77% drawdown. The table below shows results when testing these moving averages since 1950. Which is better? It appears that the 200-day EMA is slightly better than the 200-day SMA for the S&P 500. These two moving averages were virtually identical from October 2013 to August 2014. The EMA was closer to the actual price in July and August, but the SMA closed this gap as the trend extended. The chart below shows both moving averages from June-August 2013 until August 2014. The 200-day EMA and 200-day SMA often converge during long and steady trends. Notice that the 200-day EMA turned up in late March and reacted much quicker to recent price action. The S&P 500 turned up sharply in mid February and then surged to a new high in July.

This is because of two sharp declines below 2000 and more emphasis on recent prices (blue area). Notice how the 200-day EMA is below the 200-day SMA from August to February. The chart above shows the 200-day EMA in green and the 200-day SMA in red. EMAs react quicker to price moves and are often closer to the current price after a strong directional move. This reduces the lag, but does not completely remove the lag. Moreover, the lag increases along with the length of the moving average.Īn exponential moving average (EMA) puts more weight on recent prices and less weight on older prices. The first price point, which is 200 days ago, counts just as much as the most recent price point. A 200-day simple moving average is simply an average of closing prices for the last 200 days. The first two articles covered Advance-Decline Percent and High-Low Percent.īefore getting into this breadth indicator, it will help to clarify the difference between an exponential moving average and a simple moving average. This indicator is part of a breadth trio I use to define the market environment and keep me on the right side of the trend.

200 ema and 50 ema how to#

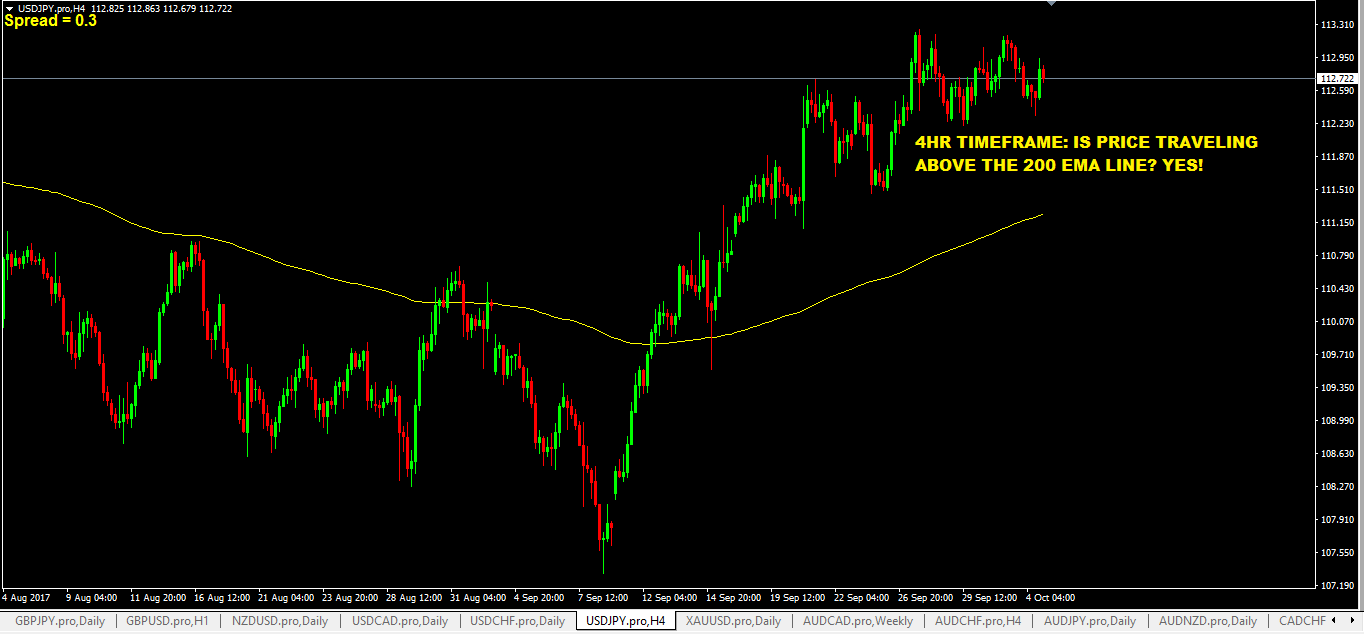

I will then show how to use the Stocks Above 200-EMA indicator to measure trend participation. This article will start by explaining the differences between a simple moving average and exponential moving average. Even though not all indexes, ETFs and stocks test well against the 200-day moving average, we can still use this moving average as a benchmark level to measure trend participation. The humble moving average remains one of the most popular methods for trend identification and the 200-day moving average is perhaps the most common timeframe. Introduction - Measuring Trend Participation SystemTrader // Introduction - Measuring Trend Participation // 200-day EMA versus 200-day SMA // Backtesting the Moving Averages // Percent above 200-day Breadth Indicator // Smoothing and Reducing Whipsaws // Capturing Broad Market Participation // Conclusions on Trend Participation // Stocks Above EMA Symbols at StockCharts ////.

0 kommentar(er)

0 kommentar(er)